Bruce Feinstein, Esq. Quoted in New York Times “Life After Bankruptcy” Article

How long do you have to wait to qualify for a mortgage after bankruptcy?

The New York Times called upon Queens bankruptcy attorney Bruce Feinstein, Esq. for his expertise and insight for their recent article, “Mortgages – Life After Bankruptcy.” Journalist Vickie Elmer interviewed Mr. Feinstein for the piece, which examines some common myths surrounding life after bankruptcy and obtaining a mortgage after a Chapter 7 or Chapter 13 filing.

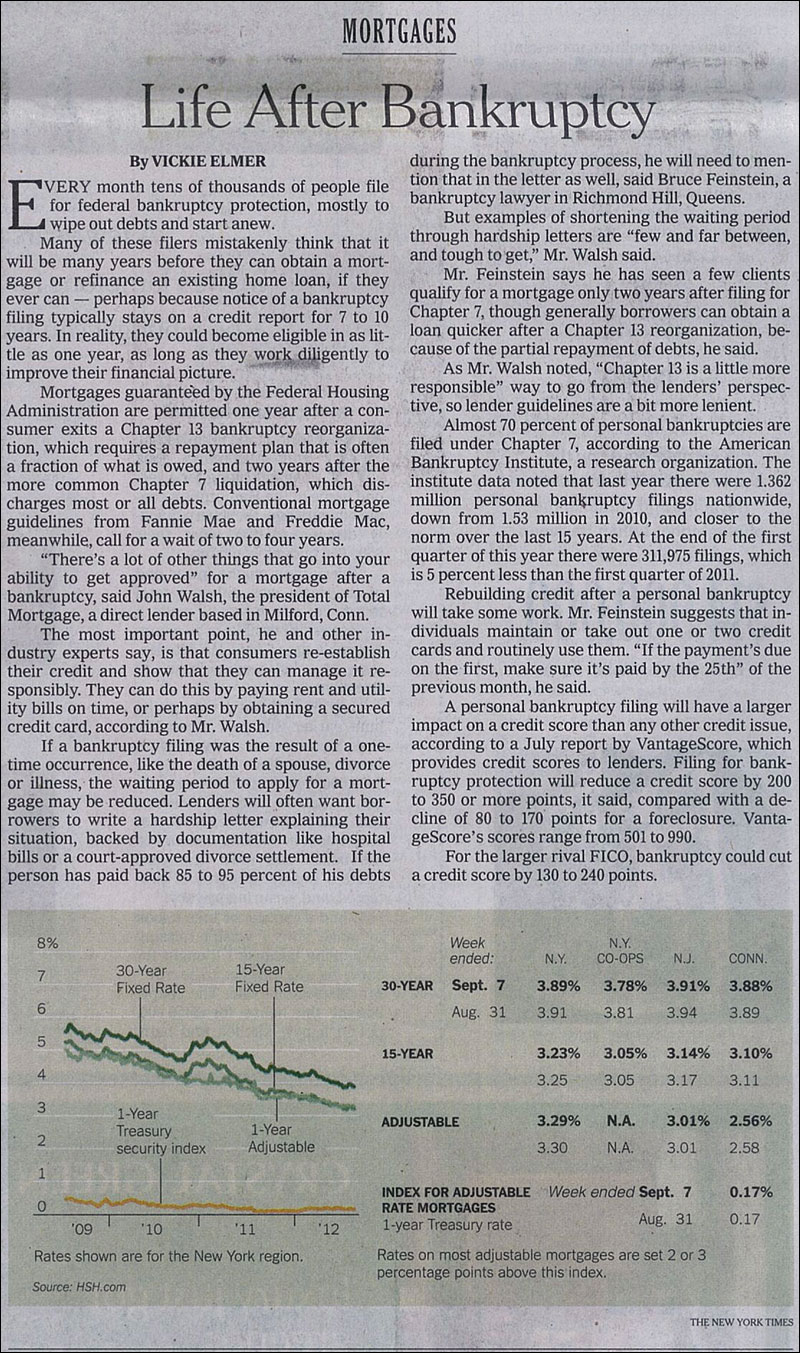

While many people think that you can’t get a mortgage for many years after your bankruptcy, the truth is that mortgages can be approved as little as one year after Chapter 13 reorganization, and two years after Chapter 7 liquidation. By establishing credit soon after bankruptcy and paying bills on time, consumers can show they are financially prepared to take on a mortgage. In fact, that time frame may be even smaller; in the article Mr. Feinstein says:

If a bankruptcy filing was the result of a one-time occurrence, like the death of a spouse, divorce or illness, the waiting period to apply for a mortgage may be reduced. Lenders will often want borrowers to write a hardship letter explaining their situation, backed by documentation like hospital bills or a court-approved divorce settlement. If the person has paid back 85 to 95 percent of his debts during the bankruptcy process, he will need to mention that in the letter as well.

The different waiting periods after a Chapter 7 bankruptcy versus and Chapter 13 bankruptcy are in place because Chapter 7 involves discharging a portion or all of an individual or business’s debt. Chapter 13, on the other hand, means that a reasonable payment plan is established to pay back an individual’s debt. In the article, Mr. Feinstein says that “he has seen a few clients qualify for a mortgage only two years after filing for Chapter 7, though generally borrowers can obtain a loan quicker after a Chapter 13 reorganization, because of the partial repayment of debts.”

If you are emerging from bankruptcy and looking to get on the right path to good credit and a mortgage, there are steps you can take to help your situation. You should get one or several credit cards (such as a secured credit card), and use them for purchases you know you can repay on time, preferably early to avoid interest. Says Mr. Feinstein, “If the payment’s due on the first, make sure it’s paid by the 25th” the month before it’s actually due.

Bruce Feinstein, Esq.’s intimate understanding of the bankruptcy code shone through in this article, and it continues to help his many clients on their own paths to financial freedom. From from finding the best debt relief option and filing a petition to rebuilding after bankruptcy, Mr. Feinstein can help you and your business get on the road to a debt-free life.

If you are considering filing for bankruptcy, or need help post-bankruptcy, Call the Law Offices of Bruce Feinstein, Esq. today for a Free Consultation!

(718) 514-9770

(Click Image to See Full-Size)

[Source: NYTimes.com]

Tags: attorney, bankruptcy, bruce feinstein esq, chapter 11, chapter 7, free consultation, interview, law office, lawyer, mortgage, new york times, queens

Trackback from your site.